Appliance Connection Credit Card: The Easiest Way to Get Approved

Appliance Connection Credit Card offers flexible payment options and accepts major credit and debit cards such as Discover, MasterCard, Visa, and American Express. With guaranteed protection against unauthorized charges, customers can shop confidently at Appliances Connection.com.

The credit card details, login process, bill payment, and customer service information can be found on the official website. Additionally, customers can benefit from special financing options provided by Comenity, making it easier to get their desired appliances from Appliances Connection.

Reviews and pre-approval information are also available, along with a dedicated helpline for any queries or assistance. Overall, Appliance Connection Credit Card is a convenient and reliable option for customers looking to make purchases and manage payments seamlessly.

Why The Appliance Connection Credit Card Is A Game-changer

The Appliance Connection Credit Card is a game-changer in the world of appliance shopping. With its numerous benefits and convenient features, this credit card offers a unique experience that simplifies the appliance purchasing process for customers. Whether you’re looking to upgrade your kitchen appliances or transform your laundry room, the Appliance Connection Credit Card can make your shopping experience hassle-free and more rewarding. In this article, we will explore the benefits of having an Appliance Connection Credit Card, how it can simplify your shopping experience, and the convenience it offers for appliance purchases.

Benefits Of Having An Appliance Connection Credit Card

Having an Appliance Connection Credit Card comes with various advantages that can enhance your appliance shopping experience. Here are some key benefits:

- Rewards and discounts: As an Appliance Connection Credit Card holder, you can enjoy exclusive rewards and discounts that are not available to regular customers. These special offers can help you save money on your appliance purchases and maximize the value you get.

- Flexible financing options: The Appliance Connection Credit Card provides flexible financing options, allowing you to choose the payment plan that suits your budget. With the option of deferred interest or fixed monthly payments, you can easily manage your payments and avoid any financial strain.

- Convenient online account management: With an Appliance Connection Credit Card, you have access to a user-friendly online portal where you can manage your account, track your purchases, and make payments. This convenience makes it easy to stay organized and keep track of your appliance orders.

- Special promotional offers: The Appliance Connection Credit Card holders often receive exclusive access to limited-time promotional offers, such as free upgrades, extended warranties, or complimentary installation services. These perks add extra value to your appliance purchase.

How The Appliance Connection Credit Card Can Simplify Your Shopping Experience

Appliance shopping can be overwhelming, with countless options and considerations to make. However, the Appliance Connection Credit Card can simplify this process and make your shopping experience more enjoyable. Here’s how:

- Easy financing: With the Appliance Connection Credit Card, you can quickly and easily finance your appliance purchase. Instead of dealing with multiple financial institutions or going through a lengthy application process, you can take advantage of the credit card’s straightforward financing options right at the point of sale.

- Streamlined checkout: When using the Appliance Connection Credit Card, the checkout process becomes seamless. You can save time by securely storing your payment information, eliminating the need to enter it every time you make a purchase. This convenience speeds up the checkout process and allows you to finalize your order with ease.

- Exclusive offers: As a cardholder, you will receive special offers and promotions tailored to your needs. These exclusive deals can help you discover new appliances, upgrade your existing ones, or take advantage of limited-time discounts. By having access to these offers, you can find the perfect appliances while enjoying additional savings.

The Convenience Of Using The Appliance Connection Credit Card For Appliance Purchases

The Appliance Connection Credit Card offers unparalleled convenience when it comes to purchasing appliances. Here’s why:

| 1. One-stop shopping: | With the Appliance Connection Credit Card, you can shop for all your appliance needs in one place. Whether you’re looking for a refrigerator, dishwasher, or washer and dryer set, you can find a wide range of options at Appliances Connection. |

| 2. Quick and easy approval: | Applying for an Appliance Connection Credit Card is a breeze. The approval process is fast, allowing you to start enjoying the benefits of the credit card in no time. |

| 3. Online and in-store flexibility: | Whether you prefer shopping online or visiting a physical store, the Appliance Connection Credit Card can be used in both environments. This flexibility ensures that you can shop for appliances conveniently, regardless of your preferred shopping method. |

To conclude, the Appliance Connection Credit Card is a game-changer in the world of appliance shopping. With its array of benefits, simplified shopping experience, and convenient features, this credit card offers a unique and rewarding experience that enhances the way you shop for appliances.

How To Apply For An Appliance Connection Credit Card

Step-by-step Guide To Applying For An Appliance Connection Credit Card

Applying for an Appliance Connection Credit Card is a simple process that can be done entirely online. Follow these step-by-step instructions to complete your application:

- Visit the Appliances Connection website.

- Click on the “Credit Card” tab located at the top of the page.

- Select the “Apply Now” button.

- You will be redirected to the Comenity bank website, where you can proceed with your application.

- Fill out the required personal information, including your name, address, and contact details.

- Provide your financial information, including your annual income and employment status.

- Review the terms and conditions of the credit card and click on the “Submit” button to complete your application.

- Wait for the approval process to be completed.

- If approved, you will receive your Appliance Connection Credit Card in the mail within a few days.

Eligibility Requirements For Obtaining An Appliance Connection Credit Card

To be eligible for an Appliance Connection Credit Card, you must meet the following requirements:

- You must be at least 18 years old.

- You must have a valid Social Security number.

- You must have a valid government-issued ID.

- You must have a good credit score.

- You must have a stable source of income.

Tips For Increasing Your Chances Of Getting Approved For An Appliance Connection Credit Card

If you want to increase your chances of getting approved for an Appliance Connection Credit Card, consider following these tips:

- Make sure your credit score is in good standing by paying your bills on time and keeping your credit utilization ratio low.

- Limit the number of credit card applications you submit within a short period of time, as excessive inquiries can negatively impact your credit score.

- Provide accurate and up-to-date information on your application form.

- Consider adding a co-signer with a strong credit history to increase your chances of approval.

- Review your credit report to check for any errors or discrepancies that could affect your application.

Understanding The Approval Process For The Appliance Connection Credit Card

When it comes to making large appliance purchases, financing options can be a game-changer. If you’re considering the Appliance Connection Credit Card, it’s crucial to understand the approval process to increase your chances of success. In this article, we’ll delve into the factors that impact approval for the Appliance Connection Credit Card, credit score requirements, and what to do if you are denied the card.

Factors That Impact Approval For An Appliance Connection Credit Card

The approval process for the Appliance Connection Credit Card takes into account several factors that determine your eligibility. These factors can vary, but some of the common ones include:

- Income level: The credit card issuer wants to ensure that you have a stable income to make timely payments.

- Credit history: Your credit history plays a significant role in the approval process. A solid credit history with a good repayment record increases your chances of approval.

- Debt-to-income ratio: Lenders consider your debt-to-income ratio to assess your ability to handle additional debt. A lower debt-to-income ratio indicates a stronger financial position.

- Employment stability: Having a stable job history is favorable when applying for a credit card. Lenders prefer borrowers with consistent employment.

It’s essential to keep these factors in mind and ensure they align with the credit card issuer’s requirements to increase your chances of approval.

Credit Score Requirements For The Appliance Connection Credit Card

Credit scores are a crucial element in credit card approval. While credit score requirements can vary, it’s generally advisable to have a good to excellent credit score to qualify for the Appliance Connection Credit Card. A credit score of 670 or higher is typically considered good, while a score of 740 or above is considered excellent.

It’s important to note that meeting the credit score requirement doesn’t guarantee approval, as other factors mentioned earlier also come into play. However, having a favorable credit score increases your chances of getting approved for the card.

What To Do If You Are Denied An Appliance Connection Credit Card

If you are denied an Appliance Connection Credit Card, there are several steps you can take to improve your chances for future approval:

- Review your credit report: Check your credit report for any errors or discrepancies that may have led to the denial. Dispute any inaccuracies and work towards improving your credit.

- Improve your credit score: Focus on building your credit by making timely payments, reducing debts, and maintaining a low credit utilization ratio.

- Consider alternative financing options: If you need immediate financing for your appliance purchase, explore other financing options such as personal loans or other store credit cards.

- Reapply in the future: Take the time to improve your financial position and credit score before reapplying for the Appliance Connection Credit Card in the future.

Remember, denial doesn’t mean you can never get approved. Take proactive steps to improve your financial situation and creditworthiness, and with time, you may qualify for the Appliance Connection Credit Card.

Using The Appliance Connection Credit Card To Finance Your Appliance Purchases

If you’re in need of new appliances for your home, the Appliance Connection Credit Card can be a great tool to help you finance your purchases. With various financing options, managing your payments, and maximizing the benefits, this credit card offers a convenient and smart way to upgrade your appliances. In this article, we’ll explore how you can make the most of the Appliance Connection Credit Card to make your appliance shopping experience easier and more affordable.

Financing Options Available With The Appliance Connection Credit Card

When it comes to financing your appliance purchases, the Appliance Connection Credit Card offers several flexible options. Whether you’re looking to buy a single appliance or outfitting your entire home, this credit card has you covered. Here are the available financing options:

- Deferred interest: With this option, you can enjoy interest-free financing for a specific promotional period. As long as you pay off the full balance within the promotional period, you won’t be charged any interest.

- Fixed monthly payments: If you prefer to have a fixed monthly payment, this option allows you to spread out the cost of your appliance purchases over a set number of months. This can help you budget your expenses more effectively.

- Special financing: From time to time, Appliance Connection may offer special financing promotions, such as 0% APR for a certain period or reduced interest rates. Keep an eye out for these offers to take advantage of additional savings.

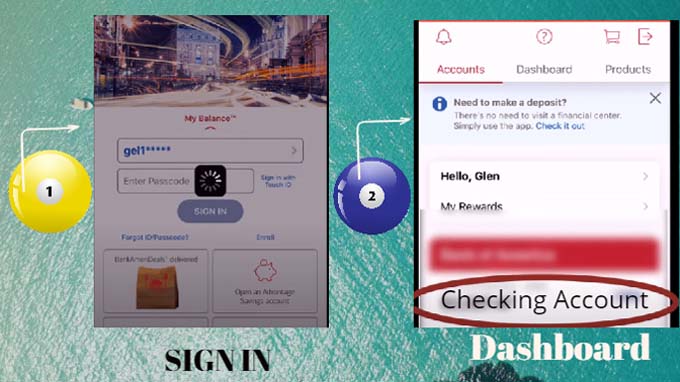

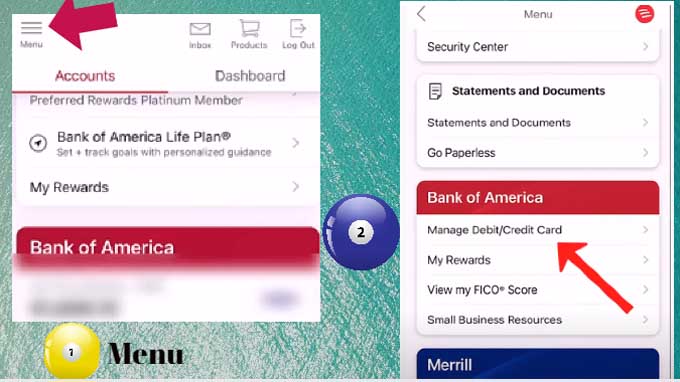

How To Make Payments And Manage Your Appliance Connection Credit Card Account

Managing your Appliance Connection Credit Card account is simple and convenient. Here’s how you can make payments and stay on top of your finances:

- Online account management: You can easily access and manage your credit card account online. Simply log in to your account through the Appliance Connection website, where you’ll be able to view your statements, make payments, and track your balance.

- Automatic payments: To ensure you never miss a payment, consider setting up automatic payments. This way, your monthly payment will be deducted from your linked bank account automatically, giving you peace of mind and avoiding any late fees.

- Multiple payment options: Appliance Connection accepts various payment methods, including major credit and debit cards. You can use your Discover, MasterCard, Visa, or American Express Card to make payments towards your credit card balance.

Tips For Maximizing The Benefits Of The Appliance Connection Credit Card

To make the most out of your Appliance Connection Credit Card, here are some tips to keep in mind:

- Pay off your balance within the promotional period: If you choose a deferred interest financing option, make sure to pay off your balance in full before the promotional period ends to avoid any interest charges.

- Take advantage of special financing promotions: Keep an eye out for special financing promotions offered by Appliance Connection. These can provide additional savings and help you finance your purchases more affordably.

- Stay on top of payments: It’s important to make your credit card payments on time to maintain a good credit history. Consider setting reminders or signing up for automatic payments to avoid any late fees or penalties.

By utilizing the financing options, managing your payments effectively, and taking advantage of special promotions, the Appliance Connection Credit Card can be a valuable tool in financing your appliance purchases. Visit the Appliance Connection website to learn more and apply for the credit card today.

Where Can I Use My Appliance Connection Credit Card?

You can use your Appliance Connection Credit Card at Appliances Connection, an authorized retailer for a wide range of appliances, furniture, and home goods. With this card, you’ll have access to exclusive financing options and special promotions.

Appliances Connection Credit Card Review

The Appliances Connection Credit Card offers a convenient way to finance your purchases and take advantage of exclusive deals. This review covers its benefits, application process, and how it can help you save on your appliance purchases.

Easiest Appliance Credit Card To Get?

The Appliance Connection Credit Card is known for being one of the easiest appliance credit cards to get approved for. With a simple application process and flexible credit requirements, it’s a great option for those looking to finance their appliance purchases.

Appliance Connection Credit Card Pre Approval

Currently, Appliance Connection doesn’t offer pre-approval for their credit card. However, you can still apply and get a quick decision on your application. Just fill out the online application form, and you’ll receive an instant response regarding your credit card approval.

With the Appliances Connection Credit Card, you can enjoy the convenience of easy payments and financing options for your appliance purchases. Accepted major credit and debit cards include Discover, MasterCard, Visa, and American Express. No unauthorized charges will be incurred, giving you peace of mind when shopping.

Take advantage of this credit card and get more out of your purchase at Appliances Connection. com. Plan ahead and explore the benefits of the Appliances Connection Credit Card today.