To apply for a Hollister credit card, visit their website and fill out the online application form. The application process is simple and can be completed in just a few minutes.

A Hollister credit card into your financial arsenal can be a smart move, offering exclusive benefits and rewards tailored to the trendy clothing retailer. Whether you’re a frequent Hollister shopper or simply seeking a new credit card option, applying for a Hollister credit card is a straightforward process.

By visiting their website and filling out the online application form, you can have your application submitted within minutes. In this guide, we will walk you through the step-by-step process of applying for a Hollister credit card, ensuring that you can start enjoying its benefits in no time.

Waiting For Approval

Understanding The Processing Time For A Hollister Credit Card Application

Once you’ve submitted your application for a Hollister credit card, it’s natural to wonder how long it will take to receive a response. Understanding the processing time for your application can help alleviate any anxieties and manage your expectations. While the exact timeframe can vary, there are some general guidelines to keep in mind.

In most cases, Hollister aims to process credit card applications quickly and efficiently. Typically, you can expect to receive a decision on your application within a matter of minutes. The online application system is designed to instantly review and evaluate your information, allowing for a swift response. This means that you won’t need to wait for days or weeks to find out whether your application has been approved or denied. Instead, you can enjoy a prompt response, providing you with clarity and enabling you to move forward with your financial plans.

However, it’s important to note that the processing time can be influenced by various factors. For instance, if there are any discrepancies or errors in the application, it may take longer for the lender to review and validate your information. Additionally, during peak application periods or unexpected circumstances, there might be a temporary delay in the processing time. While these situations are relatively rare, it’s essential to remain patient and allow the team at Hollister sufficient time to thoroughly review your application.

Checking The Application Status And Following Up If Needed

After submitting your Hollister credit card application, it’s natural to eagerly anticipate a response. While the online system provides a quick decision in most cases, there may be instances where you need to check the application status or even follow up with the Hollister team. Fortunately, Hollister provides an easy way to track the progress of your application.

To check the status of your credit card application, you can visit the Hollister website and navigate to the credit card section. There, you’ll find a designated page or portal where you can log in using your application credentials. Once logged in, you can view the current status of your application. It’s important to note that the system is regularly updated, ensuring you have the most up-to-date information at your fingertips.

If you find that your application status is not readily available or you encounter any issues while checking, it’s recommended to reach out to the Hollister customer service team directly. They will be able to assist you in resolving any concerns or queries you may have about your application. Remember, proactive communication is key when it comes to ensuring a seamless process.

By understanding the processing time for a Hollister credit card application and knowing how to check the application status, you can navigate the waiting period with ease. While there may be some variations in the processing time due to unforeseen circumstances, Hollister strives to provide prompt responses to help you begin enjoying the benefits of your new credit card as soon as possible.

Submitting The Application

Reviewing The Application Form For Accuracy And Completeness

When applying for a Hollister Credit Card, it is essential to review the application form for accuracy and completeness. To increase your chances of approval, pay close attention to each section and ensure that all the information provided is correct and up-to-date. To start, carefully read through the entire application form. Verify that your personal details, such as your name, address, and contact information, are entered accurately. Any errors in these fields could potentially lead to delays or even rejection of your application. Next, review the financial information section of the application. It is critical to be honest and accurate when providing your income, employment details, and monthly expenses. Any discrepancies or inconsistencies in this section may raise red flags and could affect your chances of approval. Additionally, take the time to double-check your Social Security number and other identification details. These pieces of information are essential for verifying your identity and establishing your creditworthiness. Any errors in these areas could result in the application being invalidated. By thoroughly reviewing the application form and ensuring the accuracy and completeness of the provided information, you are taking proactive steps towards a successful credit card application.

Submitting The Application Electronically Or Through Mail

Once you have reviewed the application form and verified its accuracy, it’s time to submit the application. Hollister provides two convenient options: electronic submission or mailing the form. Electronic submission: To apply online, visit the Hollister website and navigate to the credit card application page. Fill out the required fields electronically, following the instructions provided. Make sure to carefully review the information you entered before submitting the application online. Mailing the form: If you prefer a traditional approach, you can also choose to apply by mail. To do so, print out the application form, which you can find on the Hollister website or request from the nearest Hollister store. Fill in the required information using legible handwriting or a typewriter, ensuring accuracy and completeness. Once completed, securely seal the application form in an envelope, affix the necessary postage, and address it to the specified mailing address provided by Hollister. Regardless of the submission method you choose, make sure to include any supporting documents requested by Hollister, such as proof of income or a photocopy of your identification. These additional documents can help expedite the application process and avoid potential delays. Submitting the Hollister Credit Card application is a simple and straightforward process. By reviewing the application for accuracy and completeness, and selecting the appropriate submission method, you are one step closer to enjoying the benefits of a Hollister Credit Card.

Understanding The Benefits

Exploring The Perks And Rewards Of A Hollister Credit Card

When it comes to shopping, everyone loves a good deal. That’s why understanding the benefits of a Hollister credit card is essential. With this card in your pocket, you’ll gain access to a range of perks and rewards that can enhance your shopping experience. From exclusive discounts to special promotions, here’s what you need to know about the advantages of owning a Hollister credit card.

How A Hollister Credit Card Can Enhance Your Shopping Experience

Shopping at Hollister is already an enjoyable experience, but having a Hollister credit card can take it to the next level. With this card, you’ll find that your shopping experience becomes even more convenient and rewarding. Here are some ways a Hollister credit card can enhance your shopping experience:

- Instant savings: By using your Hollister credit card, you can enjoy instant savings on your purchases. Whether it’s a percentage off or a fixed dollar amount, these savings can add up quickly and make a real difference to your overall shopping budget.

- Exclusive promotions: As a Hollister credit card holder, you’ll have access to exclusive promotions that are not available to regular shoppers. This means you’ll be among the first to know about upcoming sales, discounts, and limited-time offers. You won’t want to miss out on these exciting opportunities to save even more on your favorite Hollister items.

- Rewards program: With a Hollister credit card, you’ll also be part of their rewards program. This means every time you use your card, you earn points that can be redeemed for future purchases. The more you shop, the more you’ll accumulate points, giving you the chance to enjoy even greater savings in the future.

Overall, owning a Hollister credit card opens up a world of benefits and rewards for avid shoppers. Whether you’re a frequent Hollister customer or simply enjoy exploring the latest fashion trends, having this card in your wallet will undoubtedly enhance your shopping experience. From instant savings to exclusive promotions and a rewarding points system, a Hollister credit card is a valuable tool that every fashion-forward individual should consider.

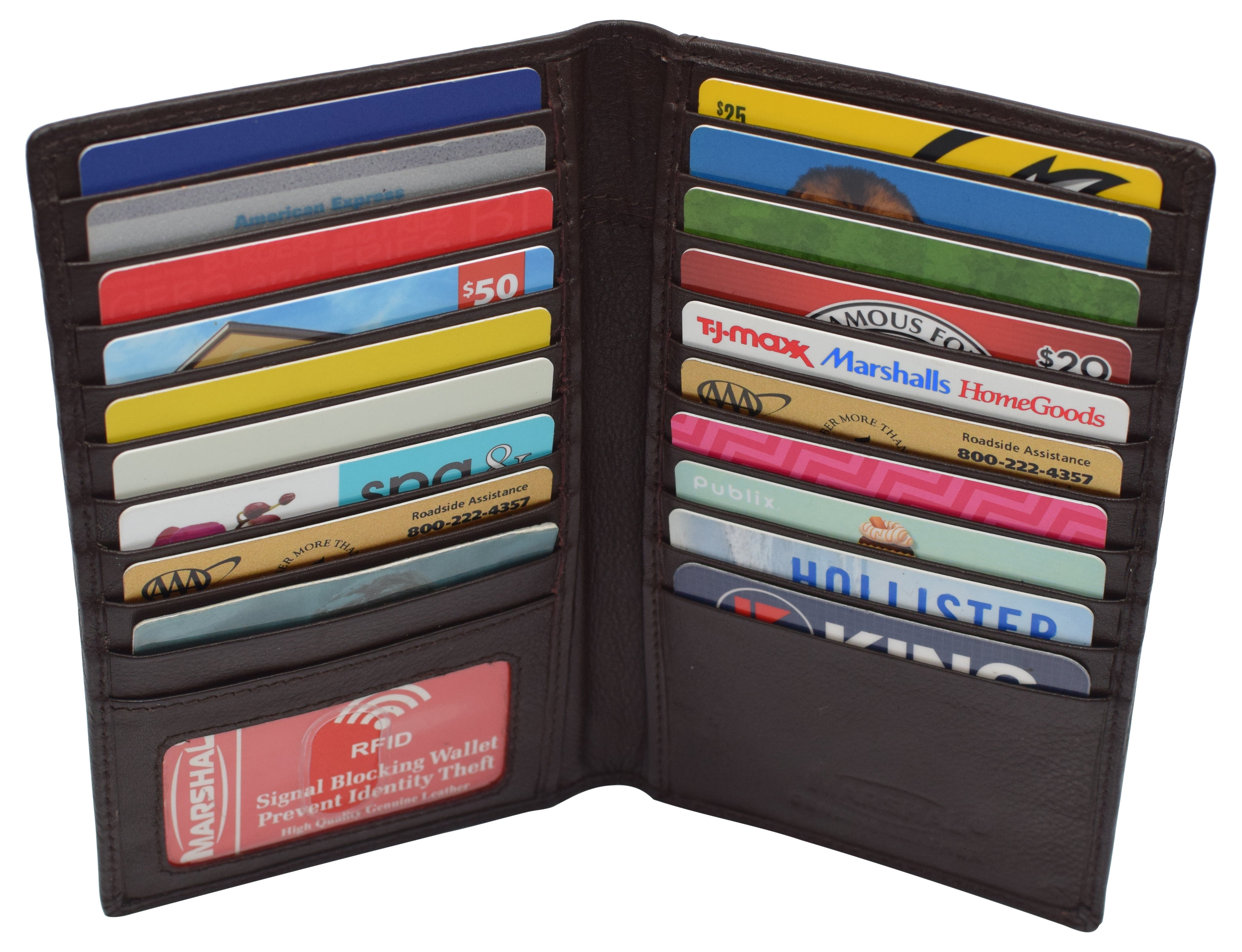

Credit: marshalwallet.com

Eligibility And Requirements

Checking The Eligibility Criteria For A Hollister Credit Card

Are you a fan of Hollister’s trendy and stylish clothing? If so, you may be interested in applying for a Hollister credit card to enjoy exclusive benefits and rewards. Before you dive into the application process, it’s essential to understand the eligibility criteria. By meeting these requirements, you can increase your chances of being approved for a Hollister credit card. So, let’s take a closer look at the eligibility criteria you need to fulfill.

Gathering The Necessary Documents And Information

Once you have determined your eligibility, the next step is to gather the required documents and information. This will help ensure a smooth and efficient application process. Before you begin, it’s vital to have a checklist to ensure you have everything in order. Here are the necessary documents and information you may need to provide when applying for a Hollister credit card:

- Personal Information: You will need to provide your full name, date of birth, contact details, and Social Security number. It’s essential to double-check the accuracy of this information as any discrepancies may delay the approval process.

- Proof of Identification: To verify your identity, you may be required to provide a valid government-issued identification document, such as a driver’s license, passport, or state ID.

- Proof of Income: Hollister may require you to submit proof of income, such as recent pay stubs, bank statements, or tax returns. This information is necessary to ensure that you have the means to repay your credit card debt.

- Residential Information: You may need to provide your current address and length of residence. This may include information such as your rental agreement or mortgage statement.

- Employment Details: Hollister may request information about your current employment, including your employer’s name, address, and phone number. Be prepared to provide this information accurately.

It’s important to gather all the necessary documents and information in advance to avoid any delays or obstacles during the application process. By being well-prepared, you can ensure a smooth and efficient credit card application experience. Remember, meeting the eligibility criteria and having the necessary documents and information are crucial steps in applying for a Hollister credit card. By following these guidelines and properly preparing for the application process, you can increase your chances of getting approved and start enjoying the benefits and rewards that come with being a Hollister cardholder.

Completing The Application Form

Applying for a Hollister Credit Card is a straightforward process that can be done online. In order to complete the application form, you will need to provide personal information as well as input your financial details. By following the steps outlined below, you can get started on your path to earning rewards and enjoying exclusive perks with the Hollister Credit Card.

Providing Personal Information, Including Name, Address, And Contact Details:

When applying for the Hollister Credit Card, it is essential to provide accurate personal information. This includes your full name, current address, and contact details. Filling out this information correctly is crucial to ensure that your application is processed smoothly and quickly.

In the application form, you will need to enter your full name in the designated field. Be sure to enter your name as it appears on your official identification documents. This will help avoid any discrepancies or delays in the application process.

Next, you will need to provide your current address. It is important to enter your address accurately so that the credit card company can send important correspondence, such as statements and other account-related information, to the correct location.

Additionally, you will need to include your contact details, such as a valid phone number and email address. This information enables the credit card company to reach out to you if they need to confirm any details or notify you regarding your application status.

Inputting Financial Information, Such As Income And Employment Details:

Aside from your personal information, you will also need to provide financial details when completing the application form. This includes your income and employment information, which helps the credit card company assess your eligibility for the Hollister Credit Card.

Specify your income accurately, providing the exact amount you earn before taxes and deductions. This information allows the credit card company to evaluate your financial capability and determine your credit limit.

Additionally, you will need to provide your employment details, including your current employer’s name and address. Include the length of time you have been employed at your current job to provide a comprehensive picture of your employment stability.

Remember, providing honest and accurate financial information is essential for a successful credit card application. Any discrepancies or false information can result in a delayed or denied application.

By filling out the application form with the required personal and financial information, you are taking the first step towards obtaining a Hollister Credit Card. Remember to review the details you have entered before submitting your application to ensure accuracy. Once your application is approved, you can start enjoying the benefits and rewards that come with being a Hollister Credit Cardholder.

Initiating The Application Process

If you’re an avid shopper at Hollister and want to unlock exclusive perks and rewards, applying for a Hollister credit card is a smart move. With the Hollister credit card, you can enjoy benefits like discounts, special promotions, and insider access to new arrivals. To get started on your application journey, follow these simple steps:

Visiting The Official Hollister Website And Navigating To The Credit Card Section

The first step towards applying for a Hollister credit card is to visit the official Hollister website. Open your preferred web browser and enter “www.hollisterco.com” in the address bar. Once the website loads, scroll down and look for the navigation bar at the top of the page. Locate the “Credit Card” option and give it a click. This will direct you to the dedicated credit card section, where you can find all the relevant information about the Hollister credit card.

Creating An Account Or Logging In To Access The Application Form

Now that you’re in the credit card section of the Hollister website, it’s time to take the next step and access the application form. If you already have an account with Hollister, you can simply log in using your existing credentials. Look for the “Sign In” or “Log In” button on the page and click on it. Enter your email address and password to gain access to your account. On the other hand, if you’re new to Hollister or haven’t created an account, worry not! Look for the “Create Account” or “Register” button and click on it to begin the account creation process. Provide the required information, such as your name, email address, and password, to set up your Hollister account.

Once you’re logged in to your Hollister account, navigate to the credit card section again. Look for the “Apply Now” button or any similar option that indicates the credit card application form. Click on it to proceed to the next step. The application form will prompt you to provide personal details, such as your name, address, phone number, and social security number. Fill in the required fields accurately and double-check for any errors before submitting your application.

That’s it! Now you’re one step closer to becoming a Hollister credit cardholder. Keep an eye out for any confirmation or further instructions from Hollister regarding the status of your application. Once approved, you’ll soon be enjoying the fantastic perks and benefits that come with being a Hollister credit cardholder. Happy shopping!

Researching Hollister Credit Card Options

Before applying for a Hollister Credit Card, it’s important to research the different options available. By comparing the various types of credit cards offered by Hollister, you can find the one that best suits your needs and preferences. In this section, we will guide you through the process of researching and selecting a Hollister Credit Card that fits your lifestyle.

Comparing The Different Types Of Hollister Credit Cards Available

When it comes to applying for a Hollister Credit Card, it’s essential to understand the different types of cards available. Hollister offers a range of credit cards, each with its own benefits and features.

Hollister offers the following types of credit cards:

| Card Name | Benefits |

|---|---|

| Hollister Store Card |

|

| Hollister Visa Card |

|

By comparing these different types of Hollister credit cards, you can determine which one aligns with your spending habits and preferences. If you primarily shop at Hollister and want to enjoy exclusive discounts and rewards, the Hollister Store Card may be the right choice for you. On the other hand, if you frequently make purchases outside of Hollister and want to earn rewards on those transactions as well, the Hollister Visa Card may be more suitable.

Finding The Card That Best Suits Your Needs And Preferences

It’s important to choose a credit card that fits your lifestyle and financial goals. Consider the following factors when selecting a Hollister Credit Card:

- Your shopping habits: If you regularly shop at Hollister, a Hollister Store Card can provide you with exclusive benefits and discounts. If you prefer a credit card that you can use not only at Hollister but also elsewhere, the Hollister Visa Card would be a better option.

- Rewards and perks: Evaluate the rewards program and additional perks offered by each card. Determine if the rewards align with your spending patterns and if the perks are appealing to you.

- Interest rates and fees: Review the interest rates, annual fees, and other charges associated with each card. Ensure that you are comfortable with the terms and conditions.

By considering these factors and conducting thorough research, you can find the Hollister Credit Card that best suits your needs and preferences.

Activating And Managing Your Hollister Credit Card

Welcome to the world of Hollister and its exclusive credit card benefits! Once you have successfully applied and been approved for a Hollister Credit Card, it’s time to activate and manage your new card. In this section, we will guide you through the process of activating your card and provide valuable tips on managing and making the most out of your new Hollister Credit Card. Let’s get started!

Learning How To Activate Your Newly Approved Hollister Credit Card

Activating your Hollister Credit Card is a simple and straightforward process. Follow the steps below to get your card up and running:

- Visit the official Hollister website at www.hollisterco.com/shop/creditcard.

- Look for the ‘Account’ button on the top-right corner of the homepage and click on it.

- In the drop-down menu, select ‘Activate Card’.

- You will be prompted to enter your personal information, card details, and security code.

- Review the terms and conditions, agree to them, and click on ‘Activate’.

- Congratulations! Your Hollister Credit Card is now activated and ready to use.

Exploring Ways To Effectively Manage And Make The Most Of Your Credit Card

A credit card can be a powerful financial tool if managed wisely. To help you maximize the benefits of your Hollister Credit Card, here are some tips:

1. Understand your credit card terms and conditions

Before making any purchases, take the time to read and familiarize yourself with the terms and conditions of your Hollister Credit Card. Pay close attention to the interest rates, fees, and any rewards or special offers.

2. Keep track of your purchases and payments

Maintain a record of your credit card transactions to stay on top of your spending. Regularly review your statements and ensure that all charges are accurate. Schedule payment reminders or enroll in automatic payments to avoid late fees and penalties.

3. Set a monthly budget

Create a budget that aligns with your financial goals and stay within your means. Avoid overspending and try to pay off your credit card balance in full each month to avoid accumulating unnecessary debt.

4. Take advantage of rewards and discounts

Hollister Credit Cardholders enjoy exclusive perks such as rewards points, discounts, and early access to sales. Make sure to take advantage of these benefits and redeem your rewards for savings on future purchases.

5. Protect your credit card information

Keep your credit card details secure by avoiding sharing them with unauthorized individuals or on unsecured websites. Regularly monitor your account for any suspicious activity and report any unauthorized charges immediately.

By activating and managing your Hollister Credit Card responsibly, you can enjoy the convenience and rewards it offers while maintaining your financial well-being. Follow these tips and make the most out of your new Hollister Credit Card experience!

Frequently Asked Questions For How To Apply For Hollister Credit Card

Does Hollister Have Credit?

Yes, Hollister offers credit options for its customers. They have a credit program that allows you to make purchases and pay later. It’s a convenient way to shop and manage your expenses.

How Do You Get Approved For A Credit Card?

To get approved for a credit card, follow these guidelines: 1. Establish a good credit history. 2. Maintain a steady income. 3. Pay bills on time and keep debts low. 4. Check your credit report for accuracy. 5. Compare credit card options and apply for one that suits your needs.

How Do I Apply For Apply Credit Card?

To apply for a credit card, visit the bank’s website or go to the nearest branch. Fill out the application form, providing your personal and financial details. Remember to submit the required documents, such as identification and proof of income.

Await approval, and once it’s granted, your credit card will be delivered to you.

What Credit Cards Does Hollister Accept?

Hollister accepts a variety of credit cards, including Visa, Mastercard, American Express, and Discover.

Applying for a Hollister Credit Card is a simple process that can offer great benefits to fashion lovers. By following the steps provided, you can access exclusive rewards, discounts, and special offers. Take advantage of this opportunity to elevate your shopping experience and enjoy the perks of being a Hollister cardholder. Start your application today and open the door to a world of stylish possibilities.